Forget Beachbody ready, are you Brexit ready?

With summer in full swing, it’s easy to spot those who have put in the months of hard work to get themselves beach ready. But have you put in the same leg work to make sure you and your business are Brexit ready?

With the UK set to leave the EU on 31 October this year, and talk of Brexit reignited following the appointment of a new Prime Minister, now is the time to ensure you have considered the impacts on your business, and the steps you can take now to mitigate against these.

Clients and prospective clients often tell us that they do not know how to plan for Brexit because they are uncertain what the impact will be on their business. Whilst this is partly true (no one knows what the exact impact will be) there are simple steps which can be taken now to prepare for every eventuality, Deal or No Deal. Let’s look at what you need to do to be Brexit Ready.

Businesses trading with EU

Customs declarations

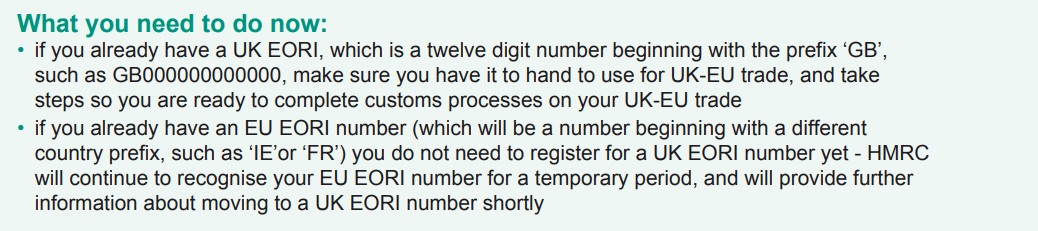

Where the UK leaves the EU without a deal, free movement of goods across the border will cease and customs controls will apply. Businesses should prepare now for this eventuality by obtaining an Economic Operator Registration Identification (EORI) number. The EORI will enable you to make customs declarations for goods imported or exported by your business. HMRC guidance states:

Source: Prepare your business for leaving the EU without a deal

Source: Prepare your business for leaving the EU without a deal

If you do not have an EORI number and need to apply for one, you can do so here. The latest figures from HMRC suggest around 250,000 businesses trade regularly with the EU, but only half currently have an EORI number. Post Brexit, businesses without an EORI will be unable to make customs declarations preventing import and export until they get one.

Consider your supply chain

Start by considering your existing contractual agreements with suppliers and customers. Do you have just in time supplies which may be delayed at a port due to customs declarations? Are you committed to agreed time-frames for delivery to customers? Understanding these will help you spot risk areas. Guidance also recommends that you consider whether you will make import and/or export declarations yourself, or use an agent to do this. If you are not familiar with customs procedures and do not have the skills in house an agent may be your preferred option, however, this will come at a cost, impacting cash flow. You can also speak to your existing freight forwarder to understand whether they will require any additional information in a no deal scenario.

Plan your response to any customs duties

It is important to bear in mind any customs duties will increase the cost of imports you bring into the UK and increase the cost to your customers of UK exports. One option is for a UK business to be responsible for the export of goods from the UK and import the goods themselves in to an EU member state, paying the customs duty itself. This will be a cost for the UK business but may help to retain customers following the initial exit. That said, a low Pound is making UK goods comparatively cheaper for EU member states, so businesses may look to pass on the cost of customs duties as the real cost may be marginal.

Consider VAT implications

Consider whether you are required to complete a VAT registration in every EU country where you sell goods. EU countries often have different VAT registration requirements for EU and non-EU businesses. We recommend if you are VAT registered overseas you check what your compliance requirements could be. The UK government has announced postponed accounting for import VAT in the event of a no deal. This is good news for UK businesses as it will help to reduce the cash flow impact of leaving the EU. Further guidance on postponed accounting is due to be released by HMRC. There is, however, likely to be a requirement to pay customs duties immediately on any imports, negatively impacting cash flow.

UK businesses with overseas group companies

The UK will no longer benefit from the EU parent subsidiary directive when it leaves the EU. In practical terms, this directive previously allowed payment of royalties, interest and dividends between the UK and EU member states to be free of withholding tax. If you have group companies in the EU (either parent or subsidiary entities) and make or receive payments for royalties, interest or dividends in the future between the UK and EU member states these may be subject to withholding tax. Currently, only 17 of the 27 tax treaties with EU member states provide for zero withholding taxes and notably countries like Italy would incur a withholding tax charge. Its important to plan for this by reviewing your group structure now.

UK businesses employing EU nationals

Existing employees who are EU nationals should apply for settled status and applications are now open here. It may also be necessary to review your employee nationality status to ensure ongoing compliance.

Businesses who are reliant on EU nations are increasingly finding it difficult to attract and/or retain these employees. You should consider whether your business will have the skills and labour it requires in the future and how it may look to mitigate this.

Final word on getting Brexit ready

These simple steps, which can be taken now, will help to mitigate the risks of Brexit to UK businesses. No-one knows what the exact terms of any withdrawal will be but take these steps now and it should leave you and your business better placed post Brexit. Hopefully food for thought when you’re laying by the pool. If you would like some help navigating Brexit and understanding exactly what it means for your business, then please do get in touch.