Tax code – all you need to know

What is a Tax Code?

HM Revenue & Customs (HMRC) will let your employer or pension provider know how much Income Tax they should take from your pay or pension by issuing a tax code. This tax code will normally start with a number and end with a letter. For the current tax year, 1250L is the standard tax code used for most people who have one job or pension. If you have not received a notice of your tax code from HMRC, you should be able to find your code on your most recent pay-slip. You can also view and check your tax code is correct via your personal tax account, which you can read more about here.

When will I receive my tax code?

Coding notices are usually sent out in January and February, ahead of the start of the new tax year (6 April). This means any changes can be put in place before the year commences. If your circumstances change during the year, perhaps you start a new job, start receiving a state pension, or employer benefits you may receive a new code part way through the year. If your tax affairs are quite simple, you may not receive an annual coding notice from HMRC at all.

What does a coding notice look like?

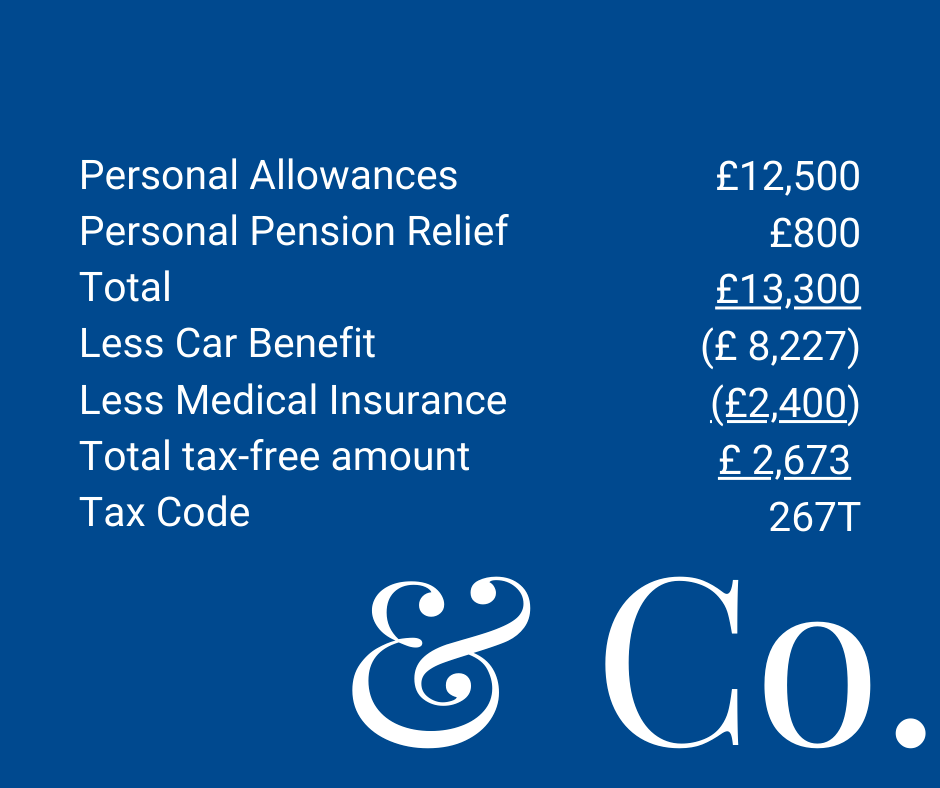

Your employer will only receive a notification of the numbers and letters that make up your tax code. However, your own coding notice will include a full breakdown of how your tax code has been calculated. This will include details of all your allowances and deductions, your net allowances and then finally your tax code. A typical tax code could look like this:

What if my Tax Code is incorrect?

If you have the wrong tax code, it is likely that you will either pay too little or too much tax over the course of the tax year. It is a good idea to pass your coding notices to your accountant. They can check they are accurate and contact HMRC to request any necessary changes. This will ensure you pay the correct tax, where possible, during the year at source.

If you are within the self-assessment system, please be aware that that once your self-assessment tax return has been filed with HMRC, your taxes are re-calculated and so if you haven’t paid the correct tax at source, any over/under payment will be dealt with through the submission of your tax return every year.

If you are not within self-assessment, after the end of tax year HMRC should carry out an automatic review of all the information held on their systems. This will include any P11D benefits and expense/relief claims (that they are aware of). HMRC will then raise any PAYE assessments (P800s) that they feel are appropriate. Where you are not in self-assessment you can still notify HMRC of changes through your personal tax account, to help you pay the correct amount of tax during the year. Read more about that here.

The numbers in my tax code

The numbers are usually the amount you can earn before any tax is due, divided by 10. So, for a code of 1250L this means that you can earn £12,500 (1250 x 10) during the tax year before becoming liable to Income Tax.

The letter in my code

People often wonder what the letter at the end of their tax code means. Sadly its rather unexciting! It really is just an indication of the type of code you are on. Your employer or pension provider often use the letters to determine what annual increase they need to apply to your code when the tax year changes. The most common letters and a brief explanation are as follows:

L – You’re entitled to the basic tax-free personal allowance.

N – You have elected to use your Marriage Allowance to transfer 10% of your unused personal

allowance to your spouse or civil partner (basic rate taxpayers only).

M – you’ve received a transfer of 10% of your spouse or civil partner’s personal allowance.

K – if there is a K at the beginning of your code, your total deductions in your code (benefits, untaxed income etc.) exceed your total allowances. The K code will ensure you pay tax on the excess.

T – Your code includes other calculations in order to work out your Personal Allowance. This may be because you earn over £100k or some items in the code need reviewing with the taxpayer.

0T – Your personal allowance has already been used up. Alternatively, you’ve started a new job and did not pass your employer your P45 from your previous employment.

BR – All your income from this job/pension is taxed at the basic rate of tax (20% currently).

D0 – All your income from this job/pension is taxed at the higher rate of tax (40% currently).

D1 – All your income from this job/pension is taxed at the additional rate of tax (45% currently).

W1 or M1 – if your code has W1/M1 at the end, this is an emergency code. It means you are being taxed on the amount you’ve earned in the particular payslip period and not cumulatively (on your overall year-to-date earnings).

Regardless of what tax code you have, your employer/pension provider is unable to take more than 50% in tax from your pre-taxed earnings as this could cause hardship.

If you do have any questions regarding this blog or any other matters, please contact us for assistance or give us a call on 01276 61203.