Construction Services Domestic Reverse Charge

HMRC have announced a 12 month postponement to the introduction of Domestic Reverse Charge for VAT. The rules for the construction industry will now come in to force from 1 October 2020 as opposed to 1 October 2019.

From 1st October 2019 a new domestic reverse charge for construction services comes into force. This will be introduced without a transitional period and will have a significant impact on the accounting and cash flow of businesses within the construction industry.

HMRC have confirmed there will be a soft touch in dealing with any errors made within the first 6 months as long as the business is trying to comply with the new legislation and have acted in good faith.

Subcontractors will lose the opportunity to use VAT to fund cashflow between the time it is received from the customer and the time it must be paid over to HMRC. Conversely, contractors will no longer suffer a delay between paying out VAT and recovering it.

Why is this being introduced?

Following a consultation undertaken by HMRC the aim of the new policy is to combat “missing trader fraud”, within the construction sector. In practical terms, this is the reclaim of input VAT on purchases where the supplier has no intention of ever paying the VAT to HMRC.

How will it work?

A VAT registered business that supplies certain construction or building services (see below) to another VAT registered business for onward sale will be required to issue an invoice, with no VAT, stating that the service is subject to the domestic reverse charge.

The customer/recipient, if VAT registered, must then account for VAT due on that supply via its VAT return at the appropriate rate instead of paying the VAT to the supplier.

The recipient may recover that VAT amount as input tax, subject to the normal rules – which is likely to mean a nil net tax position.

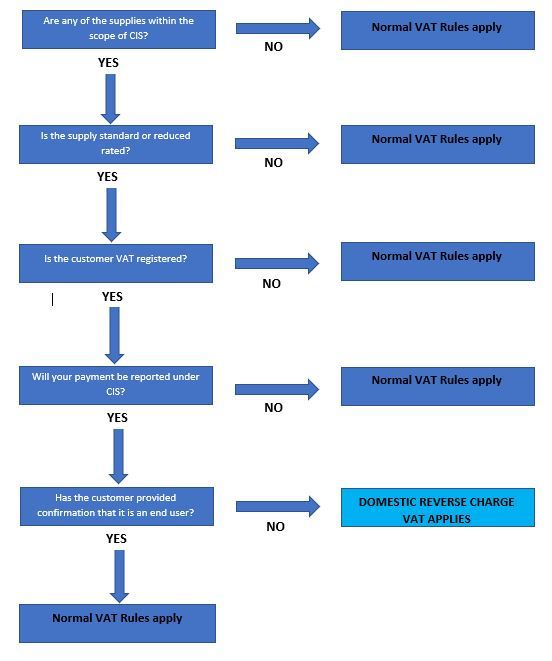

If you are VAT registered, the flow chart below details the questions to consider for each supply within the construction sector:

Some key definitions:

- CIS – Construction Industry Scheme

- Standard Rated and Reduced Rated – 20% and 5% VAT

- End user – the consumer or final customer.

Which services are affected?

The reverse charge will apply to supplies of building and construction services which are either standard or reduced rated and need to be reported under CIS.

It will not apply to services which are zero rated or if the customer is not registered for VAT in the UK.

Note that the reverse charge applies to the whole service, including materials, unlike CIS which is labour only.

It does also not apply to services that are supplied to end users or intermediaries connected with end users.

The supply of the following services are included:

- constructing, altering, repairing, extending, demolishing or dismantling buildings or structures (whether permanent or not), including offshore installation services

- constructing, altering, repairing, extending, demolishing of any works forming, or planned to form, part of the land, including (in particular) walls, roadworks, power lines, electronic communications equipment, aircraft runways, railways, inland waterways, docks and harbours

- pipelines, reservoirs, water mains, wells, sewers, industrial plant and installations for purposes of land drainage, coast protection or defence

- installing heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection systems in any building or structure

- internal cleaning of buildings and structures, so far as carried out in the course of their construction, alteration, repair, extension or restoration

- painting or decorating the inside or the external surfaces of any building or structure

- services which form an integral part of, or are part of the preparation or completion of the services described above – including site clearance, earth-moving, excavation, tunnelling and boring, laying of foundations, erection of scaffolding, site restoration, landscaping and the provision of roadways and other access works

The supply of the following services are excluded:

- drilling for, or extracting, oil or natural gas

- extracting minerals (using underground or surface working) and tunnelling, boring, or construction of underground works, for this purpose

- manufacturing building or engineering components or equipment, materials, plant or machinery, or delivering any of these to site

- manufacturing components for heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection systems, or delivering any of these to site

- the professional work of architects or surveyors, or of building, engineering, interior or exterior decoration and landscape consultants

- making, installing and repairing art works such as sculptures, murals and other items that are purely artistic

- signwriting and erecting, installing and repairing signboards and advertisements

- installing seating, blinds and shutters

- installing security systems, including burglar alarms, closed circuit television and public address systems

What should my construction business do now to prepare?

- Review existing supplies made to and received from other VAT registered contractors to establish if they will be subject to a reverse charge from October 2019

- Obtain notification from customers that they are an end user and confirmation of their VAT registration and CIS status

- Consider and make any required amendments to record keeping and accounting systems

- Consider the impact on cash flow and if there are any ways to mitigate this.

A final point to consider

Some businesses may find that, because they no longer pay VAT on some of their sales to HMRC, they become a repayment trader (their VAT return is a net claim from HMRC instead of a net payment).

Repayment traders can apply to move onto monthly returns to speed up payments due from HMRC which in turn will assist with cash flow.

If you have any questions regarding the Construction Services Domestic Reverse Charge or any other matter, please contact us for assistance.