Corporation Tax Rates and Capital Allowances

As normality slowly begins to resume and more certainty around the future of a post pandemic environment is gained it is time to start thinking about building back our businesses.

For a lot of companies, the pandemic has instigated a change in the way we work and as part of this investing in new technology. Below we discuss the future of corporation tax rates, recent capital allowance changes and the announcement of the new super deduction.

Corporation Tax Rates

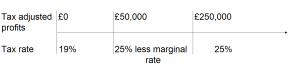

Currently the rate of corporation tax on a company’s taxable profits is 19%. The Chancellor announced in his March 2021 Budget that this would rise to 25% from 1st April 2023.

As you would expect with tax it is never that straight forward; from 1st April 2023 the corporation tax rate will depend on the level of company’s profits. A company with profits under £50,000 will still pay corporation tax at 19%, whereas a company with profits over £250,000 will pay corporation tax at the 25% rate.

Companies with profits between £50,000 and £250,000 will pay corporation tax at a tapered rate of between 19% and 25%. These limits are divided between associated companies under common control.

To put the above into context we have 3 scenarios below which should hopefully make this clearer:

SCENARIO 1:

Taxable profits of £40,000

Corporation tax of £7,600 (tax rate 19%)

SCENARIO 2:

Taxable profits of £100,000

Corporation tax of £22,750 (effective tax rate 22.75%)

(first £50,000 @ 19% = £9,500 and the balance of £50,000 @ 26.5% (marginal rate) = £13,250)

SCENARIO 3:

Taxable profits of £275,000

Corporation tax of £68,750 (tax rate 25%)

Note – the tax legislation has not yet been enacted and maybe subject to change.

Capital Allowances

In the Budget the Chancellor also announced several capital allowances measures for businesses:

1) Annual Investment Allowance (AIA) – Companies and unincorporated businesses can deduct the full cost of “qualifying capital expenditure” from their company’s profits when buying assets for use in the business.

Most “plant and machinery” will qualify for AIA although there are some exceptions, for example items you lease (you must own them), buildings etc.

The AIA is for expenditure up to £1 million and runs until 31 December 2021, there are transitional rules if your accounting period straddles this date.

2) Super-deduction – Companies will be able to claim 130% allowances against their profits on qualifying expenditure on new plant and machinery (P&M) contracted for from 3rd March 2021 and incurred from 1st April 2021 to 31 March 2023. The deduction is on those assets that would qualify for 18% writing down allowance in the main capital allowance pool.

3) First Year Allowances – There is also a first year allowance of 50% on new P&M that would usually qualify for 6% writing down allowance in the special rate capital allowance pool. This again applies to new P&M contracted for from 3rd March 2021 and incurred from 1st April 2021 to 31 March 2023.

Note – for accounting periods that straddle 1st April 2023 apportioning will be required.

It should be remembered that assets sold on which capital allowances have been claimed, can be subject to a taxable balancing charge. For example:

A company purchases a van during 2020 at a purchase price of £12,500 and gets tax relief of £2,375. The company sells this van in 2022 for £7,500 resulting in a tax charge of £1,425.

Note – this example is based on the 19% corporation tax rate up to April 2023

Summary

Changes in tax rates are inevitable but if you are looking to invest in Plant and Machinery over the next couple of years it will be worthwhile assessing your cashflow position and therefore timing of expenditure to take advantage of the capital allowances now.

For any advice on corporation tax or cash flow planning please contact us here.